Managing Money with Autism

Banks, Bank Accounts and Online Banking

Managing Money Series

Debit and Credit Cards, Online Payments and E-Wallets

Bank Loans and Credit

Saving & Budgeting

Protect Yourself From Scams

Understanding Insurance

Opening a bank account on your own and learning how to manage your own money responsibly is a big part of learning to live independently. Anyone who is more than 18 years old and can understand the concept of managing money can open a bank account. If you are under 18 years old, a parent or guardian can help you open a joint account.

The following information is partially adapted from the Everyday Banking: An easy read guide by the Financial Conduct Authority and National Autistic Society UK.

Types of Bank Accounts

1. Savings Accounts

- This account is for saving your money safely.

- You can earn a small amount of interest on your savings.

- You can deposit and withdraw money whenever you need to.

What does Interest mean?

- Interest on a savings account is extra money the bank pays you for keeping your savings with them.

-

It’s a percentage of your total savings added to your account regularly, like every month or year.

-

This is a safe and easy way to grow your money.

2. Current Account

- This account is similar to a savings account, but used differently.

- It usually offers little or no interest on your money.

- Ideal for more frequent transactions and withdrawals.

3. Fixed Deposit Account

- This account is for saving money for a fixed period, like 6 months or a year.

- You earn higher interest compared to a savings account.

- You cannot withdraw the money until the fixed period is over.

4. Joint Account

- This account is shared by two or more people.

- Everyone can put money in and take money out, and can see the balance and transactions.

- Everyone is responsible for the account, including any fees.

Why do I Need a Bank Account?

There are many benefits to having a bank account.

Security

- You can keep your money safe and manage your money easily in one place.

Access online banking

- Internet banking is now widely available, so you don’t have to visit banks as often.

Receive and make payments

- Paying bills by direct debit might give you a discount on services.

- Direct debit payments are automatic so you do not forget to pay bills.

- If you are a registered OKU in Malaysia, government financial aid can only be paid into a bank account.

What does Direct Debit mean?

- Direct debit is an automatic payment method.

-

Money is taken directly from your bank account to pay for regular bills or subscriptions.

-

You can set up and control direct debits by asking a member of staff at the bank, using online or

Convenience

- You can have a debit card, which makes it easier to pay for things and shop online.

- Your debit card may also be your ATM card.

- You can use your ATM card to take out money from ATM machines in Malaysia and sometimes in other countries.

Keep track of your money

- Banks provide you with statements, which show money that has gone in and out of your account. Use these to check your spending.

Earn interest

- You might be able to earn interest on the money in your account.

Having a bank account will help you to develop a credit score. This helps if in the future you want to borrow money from a bank or apply for a credit card as they are able to check your credit history.

What does Credit History mean?

- Your credit history is a detailed record of how well you manage borrowed money and pay it back.

- It includes information about your loans, credit cards, and other forms of credit you have used, as well as your payment history.

- Learn more about loans and credit cards in Debit Cards, Credit Cards, Online Bank Transfers and E-Wallets and Managing Money with Autism: Loans

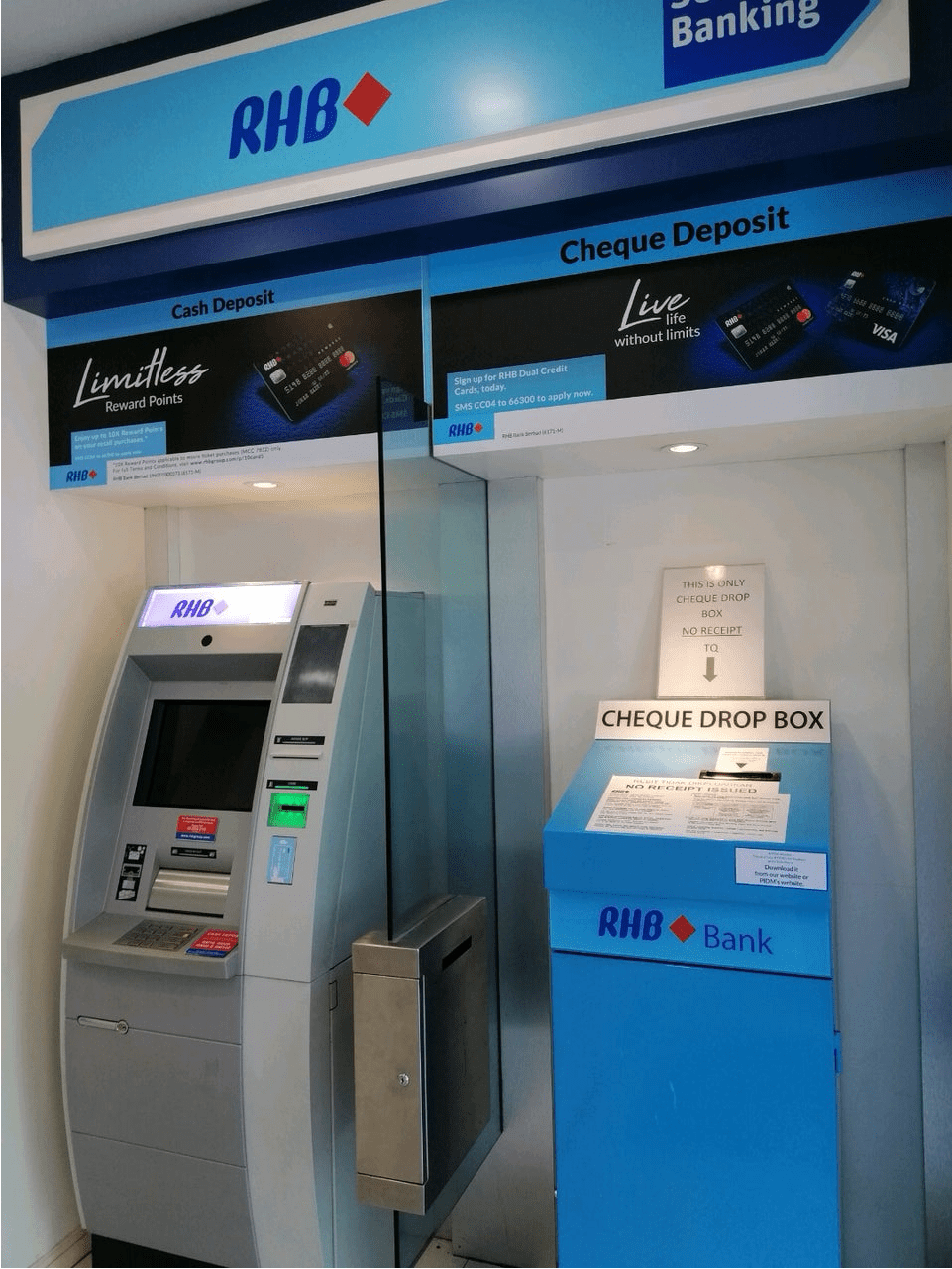

When I go into a bank, what will I see?

Machines

Here are some of the things you can do with an ATM:

- Withdraw cash: You can take money out of your bank account using your ATM card.

- Check balance: You can see how much money is in your account.

- Deposit money: Some, but not all ATMs, let you put money into your account.

If you need help using an ATM, you can ask a bank staff member for help. You can usually identify bank staff by their uniforms and name badges.

Counter Service

You can choose to use counter services instead of the machines. The staff member behind the counter can help you with most of your banking needs.

Desks/Offices

You may see lots of desks or small offices in the bank. This is where staff members can help you with more complicated products or services.

It is always best to go to the counter first. If needed, a staff member will take you to one of these desks.

Do not be afraid to ask a staff member if you are unsure about anything or have any questions. They are there to help you.

Guide to Using Bank Services in Malaysia

Disclaimer

In Malaysia, you typically open a bank account at a bank branch. Some banks may allow you to open a bank account online.

Here’s how it usually works:

Opening a Bank Account at a Bank Branch

Bring your MyKad, proof of address, and any other required documents. When you get to the bank, follow the following steps:

- Get a number from the Queue Number Machine or go to the information counter

- Wait for your turn

- Go to the counter

- Explain to the bank staff behind the counter exactly what you would like to do.

- After processing and account activation, you will receive your account details and your ATM and/or debit card.

Activating an ATM Card and Setting a PIN Number in Malaysian Banks

1. Receive your ATM Card

- When you open a bank account, the bank will provide you with an ATM card.

- You may receive the card immediately at the branch or it may be mailed to you.

- This ATM card may also function as a debit card.

For more information about debit cards, see our section on Debit Cards, Credit Cards, Online Bank Transfers and E-Wallets.

2. Activate your ATM Card

To activate your card and set a PIN, you need to visit an ATM or your bank branch.

What does PIN mean?

-

A PIN (Personal Identification Number) is a secret code you use with your bank card. It keeps your bank card safe and lets you use your money securely. Here is what it does:

- Security code: It is a 4-6 digit number that only you know.

- Use for transactions: You enter your PIN at an ATM or when making a purchase to confirm it’s you.

- Keep your money safe: Even if someone steals your card, they cannot use it without knowing your PIN.

If you face any issues during the process, ask for help from someone you trust or from a bank staff. The bank staff can guide your through the process of activating your ATM card.

Using Internet Banking

Disclaimer

Once you have opened a bank account at a bank branch, you can register for internet banking. Internet banking lets you manage your money easily from home.

1. Register for Internet Banking

- Visit your bank and ask a staff member to help you register for internet banking.

- They will give you a username and temporary password.

2. Log In

- Go to your banks website.

- Enter your username and temporary password to log in.

3. Change your password

- You will be asked to change your temporary password for security reasons.

- Choose a password that you can remember easily but can’t be easily guessed.

- Do not share username and password with strangers.

4. Perform Transactions

- Once logged in, you can see how much money you have in your account, see a list of all your recent transactions, transfer money, pay your bills and perform other transactions.

5. Security

- Make sure you log out when you’re done.

If you need help, you can call your bank’s customer service, visit your local branch or ask for help from someone you trust.

Tips for staying safe while banking online or at bank branch

Once you have opened a bank account at a bank branch, you can register for internet banking. Internet banking lets you manage your money easily from home.

1. Keep your PIN Secret

- Do not tell anyone your PIN.

- Only enter your PIN into a machine, never tell it to a person.

2. Protect your personal information

- Keep your personal and bank details to yourself.

- Do not share your information with people you do not trust.

3. Avoid suspicious links

- Do not click on suspicious links from SMS, email, or other online messages.

- Do not click on SMS/text hyperlinks that redirect you to a site or download on app to your phone.

- Banks will no longer send you clickable hyperlinks via SMS.

- Be careful when redirected to non-official or suspicious sites.

- It is safest to type in the official website address of your online banking site whenever possible.

4. Check your bank statements

- Regularly check your bank statements.

- Make sure all the money that has gone out of your account is for things you recognise and remember spending.

5. Report unrecognised transactions

- If you see any amounts you do not recognise, talk to a member of staff at your bank or someone you trust.

6. Keep your cards safe

- Make sure your credit and debit cards are safe and secure.

7. Report lost cards

- If you lose a card, speak to a member of staff at your bank or your card provider.

- They will cancel the lost card and send you a new one.

BEWARE of strangers hovering behind you at the ATM or who offer help with a “stuck” card. They do this because they want your PIN to access your account. In all circumstances, it is best to walk away and decline them.

These tips will help you stay safe and protect your money while banking.

For more information on how to use internet banking safely and protect yourself from scams, see our section on Protect Yourself From Scams